- Here's where house prices are expected to surge.

If the Reserve Bank cuts interest rates four times this year, as the major banks are predicting.

Both predict the RBA will cut rates substantially in 2025 - a forecast that real estate data group CoreLogic expects will trigger a surge in property prices in a cluster of suburbs in Australia's major cities.

Lower interest rates enable banks to lend more to customers, as monthly mortgage payments become easier to manage.

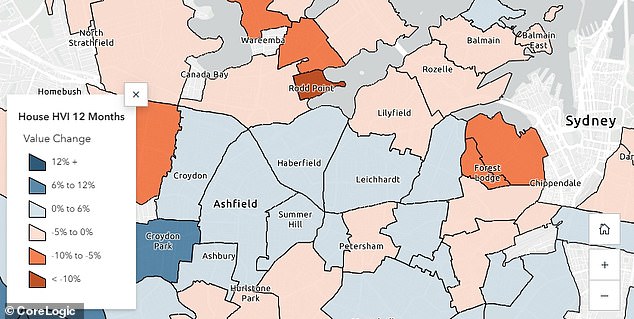

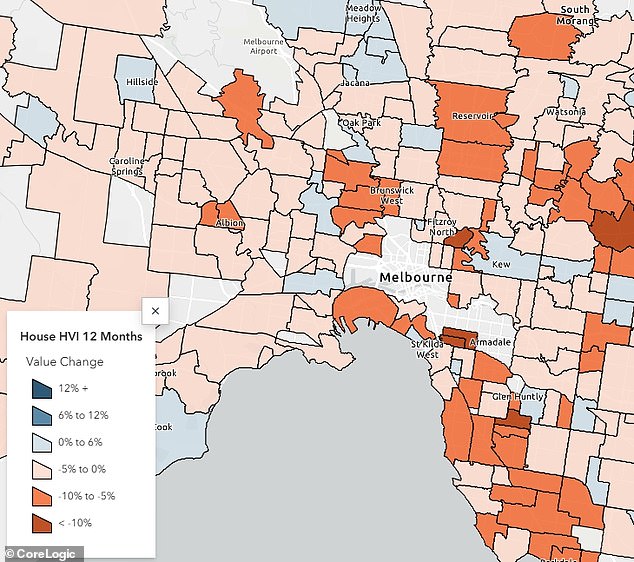

CoreLogic's head of research in Australia Eliza Owen and her colleague Robin Han, a senior quantitative analyst, stated that substantial rate reductions will stimulate markets in central Sydney and Melbourne more than anywhere else in Australia.

'Markets that traditionally require higher interest rates have consistently shown a more pronounced reaction to downward adjustments in the cash rate,' they said.

'A decrease in the cash rate could'

'Lower interest rates are expected to stimulate the housing market in 2025. With reduced rates, borrowers will be able to secure larger loans, spend more freely, and make housing a more appealing investment option.'

In the harbour area, there was a significant increase of 19.1 percent, reaching $2.329 million. Meanwhile, house prices in this upscale part of the city decreased by 6.9 percent from their peak last year.

It is anticipated to see a 19 per cent rise from $1.544 million.

It is forecast that prices will surge by 18.1 per cent from $2.413 million.

It may increase by 17.2 percent to $2.975 million.

If interest rates are reduced multiple times, it would likely lead to a decrease in the cost of borrowing money. This could stimulate economic growth by making it cheaper for individuals and businesses to take out loans and invest in various projects.

The revenue is expected to see an 18.4 percent increase from $1.431 million.

In Melbourne's inner north, an 18% rise is forecast from $1.449 million, in an area where median house prices have plummeted 14.8% below their 2022 peak.

They could see prices rise by 17.4 percent from $1.439 million.

They are only expected to experience moderate price growth in 2025 even if interest rates are cut.

In Brisbane's southern suburbs, a 5.2 percent rise is anticipated, amounting to an increase of $1.1 million.

from $845,446.

A suburb in the city's inner north-east is expected to experience a modest 3.1 percent increase in property prices, reaching $893,976, following a 16.7 percent surge in house prices in the Western Australian capital over the past year.

The value has dropped to a level not seen since March 2023.

This reduction from the current rate of 4.35 per cent would only partially offset the RBA's 13 hikes in 2022 and 2023.

Australia's four major banks are

Read more